Do not pay your next car insurance bill until you read this…

California — New policies are indicating that for years many drivers have likely overpaid on their car insurance.

The simple truth is your car insurance company doesn’t want you to know this.

Did you know, if you drive less than 50 miles/day and live in a qualified zip code you can get an extremely high discount. Additionally, depending on your age you can get even higher discounts. Has your insurance agent ever told you that?

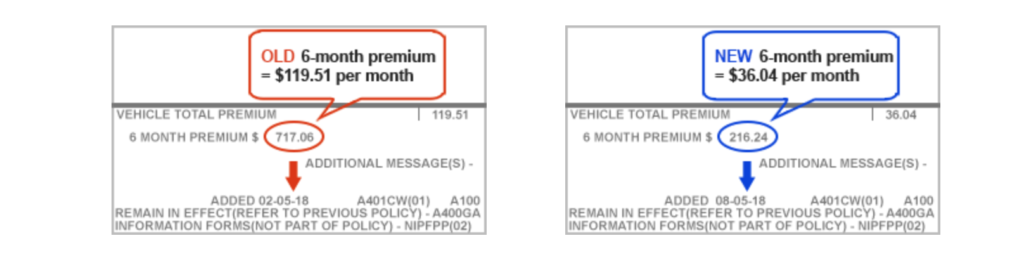

To fight back, many drivers have turned to popular online services finding MASSIVE discounts and policies as low as $63/month.

As an authority on everything insurance, we decided to put this service to the test and after entering our zip code and driver information we were shocked at the results we found.

So, what is the “One New Rule?” NEVER buy insurance without comparing all of the discounts online first.

Note: You’re NEVER LOCKED into your current policy. If you’ve already paid your bill, you can very easily cancel, and be refunded your balance.

With average savings of 32%, these online services are gaining massive popularity. One of the most trusted, secure and effective free online services to check your discounts is Provide Car Insurance. Over 1,000,000 U.S. drivers have already trusted this website to get significant discounts.

Here’s How You Do It:

Step 1: Tap your age below to match additional discounts.

Step 2: Once you enter your zip code and go through a few questions, you will have the opportunity to compare the best carrier quotes in your area for an average savings of 32% a month.

The information provided on this website is for informational purposes only. It is not intended to be, nor does it constitute any kind of financial advice. Please seek advice from a qualified professional prior to making any financial decisions based on the information provided. This site maybe compensated for clicks received.

This is an advertisement and not a news article, blog, or consumer protection update. Clarification of the advertising headline “New Rule in “. – Merriam-Webster’s Dictionary defines the word “rule” as “a piece of advice about the best way to do something” (http://www.merriam-webster.com/dictionary/rule). This article aims to advise the public that comparing rates is one of the best ways that you can save money on car insurance. No matter what city, state or zip code you live in you can compare rates and get free quotes. If you truly want to find the best rate and save on car insurance then follow our advice or “rule” to compare rates. Here are links to two surveys which demonstrate the importance of comparing rates and how applying this “rule” in any state, city or zip code can help drivers save 32% and $368 per year. A new survey found that the #1 reason people switch is because they found a cheaper rate. Click Here for Survey. A second survey which analyzed car insurance quotes for 1,000 zip codes across the U.S. found that within a given zip code, rates vary by 154% on average, allowing drivers to find an average of 32% and $368 per year in savings. Click Here For Survey.