, : There are 3 reasons your car insurance is so high and only one way to lower it. However, you car insurance company will not tell you about this because they would lose millions.

Here Are The 3 Reasons Your Insurance Is So Damn High

- Senate Bill 213

- Increased Car Accidents

- Increased Cost of Claims

Senate Bill 213

Prior to 2008, car insurance companies had to jump through hoops to get the Georgia Insurance Commissioner to approve car insurance rate increases. Then, in 2008, legislators passed the Georgia car insurance kiss of death……. Senate Bill 213. This bill allows insurance companies to increase rates without state approval.

Georgia government officials had this to say:

“We thought giving insurance companies more freedom in pricing would make things more competitive and make rates lower.”

To say the were wrong is an understatement. Ever since this bill was passed, Georgia has seen the highest car insurance rate increases 11 years in a row. Your rates increase 25%-35% twice a year. The national average is 6%.

Increased Car Accidents

Georgia has seen a HUGE increase in car accidents over the last decade. As a result, we average 3 auto deaths a day. This makes Georgia among the most dangerous states to drive in.

Accidents are up for 2 reasons:

1. Distracted Drivers On Cell Phones

2. Huge Increases In The Amount Drivers On The Road

We spoke with Lenny from Atlanta. Lenny’s living hell began with 2 little girls playing “hide-and-seek” in his front yard. Lenny is a God fearing, hardworking, husband and father. Lenny is grateful to be a father because it almost didn’t happen. For 3 years, Lenny and his wife tried and failed at having a baby. Seven doctors told them he was infertile. “We thought there was no hope. We began looking into adoption and surrogates.” said Lenny. Then, after his wife missed her period, she took a digital pregnancy test. She was pregnant! Lenny still remembers the first time he heard his daughter cry after she was born. “It was the most beautiful sound I had ever heard,” said Lenny. 4 years later Lenny was in his house washing dishes while his daughter played hide-and-seek in the front yard with her best friend. Through the window, Lenny had a clear view of the girls as he washed the dishes.

Lenny looked up and saw the girls chasing each other around the yard.

He then looked down to rinse off a coffee cup.

He looked back up and that’s when he saw it.

A Honda Accord, moving like a bat out of hell, headed directly towards the girls. He noticed the driver’s head was down because the driver was texting. He ran outside as fast as his legs would allow. By then it was too late. His daughter’s best friend managed to jump out the way. However, the car had jumped the curb, ran over his daughter and crashed through the front of his house.

“You Cannot Imagine The Sickening Feeling I Had In My Gut Unless You’ve Have Kids. I Wanted To Kill, Puke & Cry All At Once.”

His daughter suffered fractures, multiple lacerations, a broken pelvic bone and her right heart valve was leaking. By God’s grace she is still alive. Her road to recovery will be long but she will make a full recovery.

Increased Cost of Claims

The average cost of an auto insurance claims have increased by 33% in the last few years. One of the reasons the costs have increased is because of new cars with the latest technology. For example, 10 years ago if someone hit a bumper, it would cost around $200 to fix because your bumper had an average of 4 parts. You would pay this out of pocket if possible so you could avoid filing a claim that would raise your insurance rates. Today, if someone hits a bumper it can cost up to $3,000 to fix. This because the average bumper has 15 parts (back up cameras, back up sensors, etc.). Since the repair is so expensive, most people have to file a claim to get it fixed. Also, think about the car wrecks you’ve seen on highways like 20, 75, 85, etc. They sometimes involve more than one car. One car wreck incident, involving multiple cars, cost insurance companies big bucks. How do you think car insurance companies are paying for all this? They pass the bill to you by increasing your car insurance rates.

What Can You Do

We reached out to the current Georgia Insurance Commissioner. We asked

him this question. “Under Senate Bill 213, what is the best way to save money on car insurance?” He responded by saying “Georgia drivers will need to compare rates.” We were not satisfied with this poor answer so our own Jenny G. did some research. After testing well over 500 websites. The biggest problem she discovered was this:

“99% of the quotes I received did not automatically include all the discounts I qualify for. In order to get them I would have to call, wait on hold and then hope I spoke with an agent who knew what they were doing.”

However Jenny did find on little known site called Consumer Protector. It was the best site she found for 2 reasons.

- It’s Nonprofit

- It’s The Only Site That Automatically Gives You Quotes That Include ALL the Discounts You Qualify

Little known discounts for:

- No Tickets In 12 Months

- No Accidents In 12 Months

- Low Yearly Mileage

- Homeownership

- Cars Containing Back Up Cameras

- Life Insurance Policy

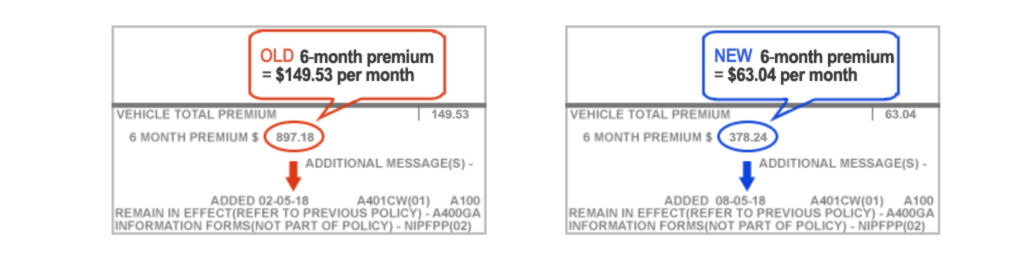

The list goes on. Below is an example of how much Jenny was able to save.

Like most drivers in Georgia you are probably paying too much for car insurance. Unfortunately, most people don’t know about the car insurance discounts they qualify for and even less know about sites like Consumer Protector.

Are you being overcharged for car insurance?

Every driver should at least take 60 seconds and learn about all the discounts you qualify for. It’s a free service that can save you thousand of dollars.

Here’s How You Do It:

Step 1: Tap The Link Below

Step 2: Enter Your Zip Code

TIP: (You are never locked into your current policy. You can cancel at any time and your remaining balance will be refunded)

*Source: https://www.cbsnews.com/news/car-insurance-california-bans-gender-as-a-factor-in-setting-rates/

*Source: https://www.insurancejournal.com/news/national/2019/02/12/517466.htm

*Study: https://consumerfed.org/press_release/large-auto-insurers-charge-40-60-year-old-women-higher-rates-men-often-100-per-year/

*Job Impact Insurance: https://quotewizard.com/auto-insurance/job-or-occupation-and-auto-insurance-rates

*Source (Why Men Pay More): https://www.esurance.com/info/car/why-women-pay-less-for-car-insurance and https://coverhound.com/insurance-learning-center/guys-vs-girls-who-pays-more-for-car-insurance

*Price Optimization: https://www.naic.org/cipr_topics/topic_price_optimization.htm

*Women and Driving: https://www.syracuse.com/news/2011/07/women_worse_drivers_more_crashes_than_men_less_driving.html

*Credit Score and Driving: https://www.ftc.gov/sites/default/files/documents/reports/credit-based-insurance-scores-impacts-consumers-automobile-insurance-report-congress-federal-trade/p044804facta_report_credit-based_insurance_scores.pdf#page=30

https://www.doughroller.net/insurance/does-bad-credit-affect-car-insurance-rates/

https://www.nerdwallet.com/blog/insurance/car-insurance-rate-increases-poor-credit/

https://www.edmunds.com/auto-insurance/does-your-credit-score-affect-your-car-insurance-rate.html

https://www.progressive.com/content/PDF/shop/UTCreditStudy.pdf

https://wallethub.com/edu/car-insurance-by-credit-score-report/4343/