, : There is a new Senate Bill your NO-Fault car insurance company is raising hell about. This is because the new Senate Bill could put a stop to the 3 reasons why Floridian’s insurance is so high.

Here Are The 3 Reasons Your Insurance Is So Damn High

- Young Drivers, Old Drivers and Tourist

- Uninsured Drivers

- Fraud

Young Drivers, Old Drivers, and Tourist

Florida has the perfect crap cocktail mix of young DUI party animals, old senile drivers and confused tourist. As a result, in recent years over 4,400 people on motorcycles and over 5,500 pedestrians have been killed by a car. Last year over 2,800 people were killed in a car accident. With numbers like that, it’s no surprise NWI has ranked Florida as one of the deadliest states to drive in.

Statiscally, The Worst Time For Car Accidents In Florida Is Between 4pm-6pm

Florida ranks among the highest states for car accidents per capita. With so many people dying or getting injured on the road, Florida responded by implementing a NO-Fault car insurance system that requires PIP (Personal Injury Protection). PIP is a car insurance policy that covers your medical costs if you get in a car accident. This may sound good but there’s just one problem.

YOU’RE Paying For Someone Else’s Medical Benefits

We will talk about this more when we get to the Fraud portion of this article. However, with such a high risk of injury or death on the Florida roads, car insurance companies must find a way to pay for it. So, they did this by passing the bill on to you. You pay extra an extra in PIP charges so you can cover someone else’s medical bills.

Uninsured Drivers

Florida has the highest insurance rates in the country. Some Floridian’s insurance payment is more than their car note. As a result, a lot of people cannot afford car insurance. Almost 1 out of 4 drivers are uninsured. To make matters worse, Florida has a HUGE hit and run problem. In 2018 there was over 100,000 hit and runs resulting in 117 deaths. Uninsured drivers are suspected to cause most the hit and runs. With so many uninsured drivers and hit and runs, Florida is a high risk state for car insurance companies. To cover the risk you are charged more.

We spoke with Jenny G. from . She was rear ended by a young, rude uninsured driver.

“I Feel Like Is One of Those Places Where People Will Intentionally Hit Each Other To Prove a Point.”

-Jenny G.

Her car only had PLPD (Personal Liability and Property Damage) and her insurance company would not help pay for the damage to her car.

She needed to switch car insurance companies so she could save money, get full coverage and never worry about getting hit by uninsured drivers again. Her boss has always been good with money so she asked him for advice.

Her boss looked over her coverage and saw she was paying triple what he pays for insurance yet he drove fewer miles and had less tickets. Her boss told Jenny about Senate Bill 896 and how she was able to find a couple of car insurance companies that were already honoring the bill.

Jenny’s husband Chris usually handled all the insurance bills but he had the flu and was in no shape to call anyone. So Jenny was forced to do her own research.

Jenny entered her zip code at Florida Consumer Shield and was furious when she saw her local insurance agent had been ripping her off for the last 8 years.

“I Lowered Our Insurance By 75% AND Got Better Coverage Thanks To Senate Bill 896. My Old Insurance Agent Is A Damn Criminal For Not Telling Me About This. I Only Wish I Found Out About This Bill Sooner.”

-Jenny G.

Fraud

A large percentage of Florida’s insurance claims are fraudulent. This adds up to over a billion dollars a year. One of the reasons there is so much fraud is because people want to take advantage of the PIP medical benefits they get when they are “injured”. With so much money going towards fraud, the insurance companies charge you $100-$200 more to cover the cost and make up for the risk.

How Senate Bill 896 Will Put Money In Your Pocket

Senate Bill 896 is the most aggressive car insurance reform the Florida Senate has ever introduced. This is because it will attack Florida’s high car insurance rates at the root. It will put an end to PIP. This means:

- Car Insurance Companies Can Afford To Charge You Less

- You Will No Longer Pay All Those Extra Fees

- There Will Be Less Insurance Fraud

This Bill has not been passed but a few companies have already prepared for it by giving Floridian’s quotes that include this new bill & any discounts they may qualify for. Florida Consumer Shield is the best sites we’ve seen for quotes that include the new Senate Bill 896 rules.

Are You Being Overcharged?

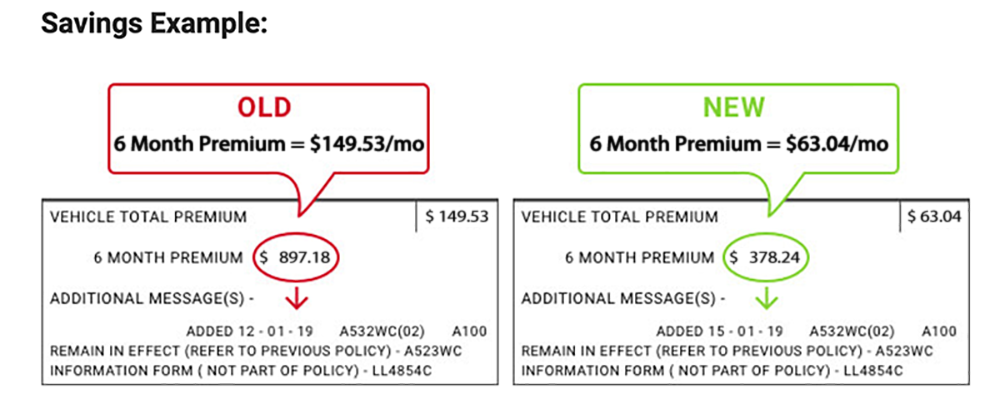

Jenny G. was. Below is an example of the savings she received after doing her research.

Like most Florida drivers you are probably paying too much for car insurance. Unfortunately, most people do not know about Senate Bill 896. Even less people know about sites like Florida Consumer Shield.

Are you being overcharged for your auto insurance? Take 60 seconds and find out if your zip code is eligible for Senate Bill 896 today. This may save you a shocking amount of money.

Here’s How You Do It:

Step 1: Tap The Link Below

Step 2: Enter Your Zip Code

TIP: (You are never locked into your current policy. You can cancel at any time and your remaining balance will be refunded)

*Source: https://www.cbsnews.com/news/car-insurance-california-bans-gender-as-a-factor-in-setting-rates/

*Source: https://www.insurancejournal.com/news/national/2019/02/12/517466.htm

*Study: https://consumerfed.org/press_release/large-auto-insurers-charge-40-60-year-old-women-higher-rates-men-often-100-per-year/

*Job Impact Insurance: https://quotewizard.com/auto-insurance/job-or-occupation-and-auto-insurance-rates

*Source (Why Men Pay More): https://www.esurance.com/info/car/why-women-pay-less-for-car-insurance and https://coverhound.com/insurance-learning-center/guys-vs-girls-who-pays-more-for-car-insurance

*Price Optimization: https://www.naic.org/cipr_topics/topic_price_optimization.htm

*Women and Driving: https://www.syracuse.com/news/2011/07/women_worse_drivers_more_crashes_than_men_less_driving.html

*Credit Score and Driving: https://www.ftc.gov/sites/default/files/documents/reports/credit-based-insurance-scores-impacts-consumers-automobile-insurance-report-congress-federal-trade/p044804facta_report_credit-based_insurance_scores.pdf#page=30

https://www.doughroller.net/insurance/does-bad-credit-affect-car-insurance-rates/

https://www.nerdwallet.com/blog/insurance/car-insurance-rate-increases-poor-credit/

https://www.edmunds.com/auto-insurance/does-your-credit-score-affect-your-car-insurance-rate.html

https://www.progressive.com/content/PDF/shop/UTCreditStudy.pdf

https://wallethub.com/edu/car-insurance-by-credit-score-report/4343/