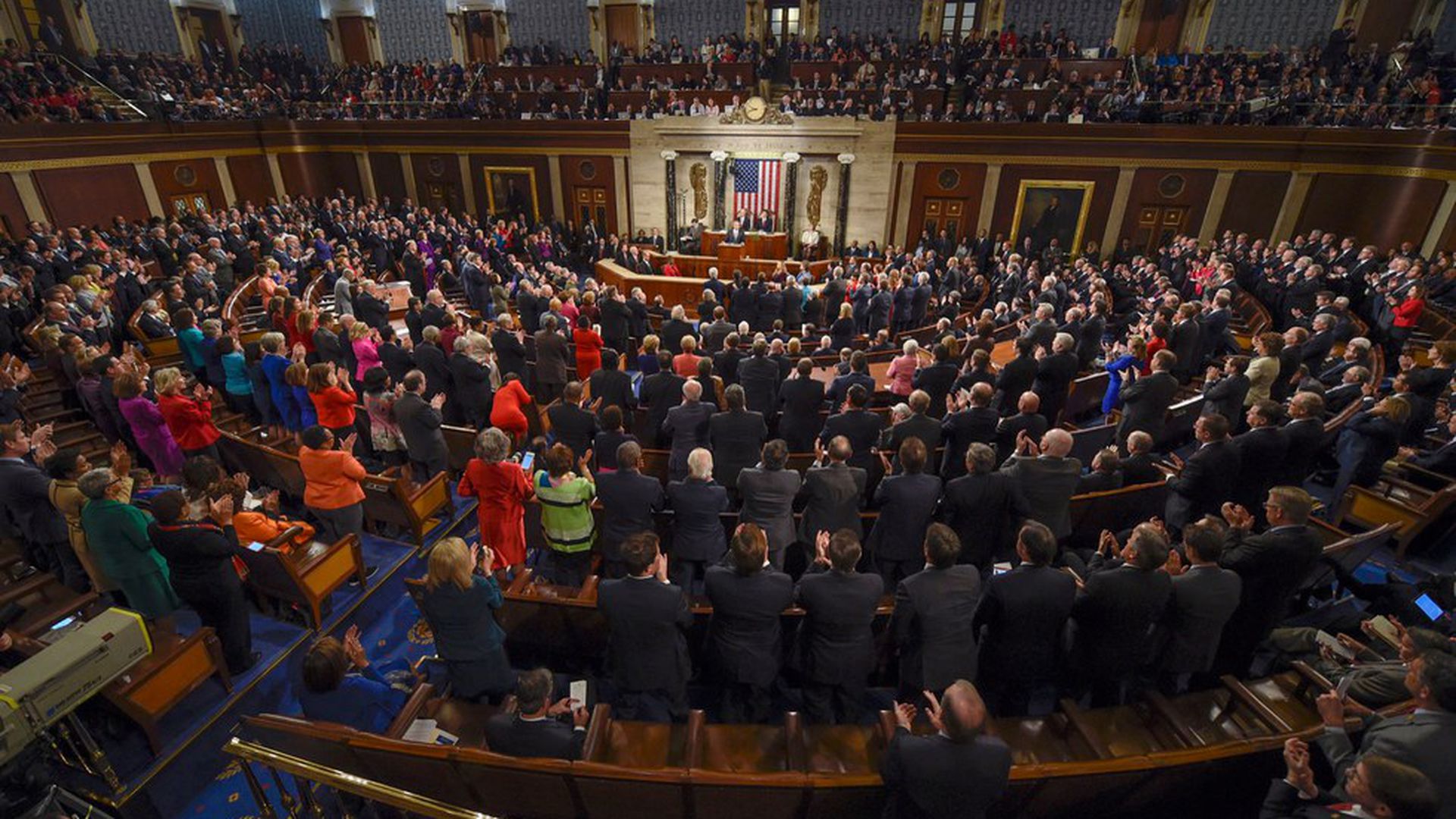

The Real Story Behind This Life Changing Debt Stimulus Package

Congress Approved Federal Debt Relief Program

Imagine how your life would be if you could pay off most of your credit cards and loans. Well, the new administration just passed a bill that could make this dream a reality.

If you:

- Owe Over $15,000 In Debt

- Are a Legal US Citizen

- Were Born Between 1939 & 1990

Then you may qualify for this life changing Stimulus Package. The new administration designed this package to attack your unaffordable debt. What that means for you is the program will freeze interest, stop future charges and allow you to pay off debt in as little as 24 to 48 months.

Check Today Ohio residents are reducing unaffordable debt. Today it is free to see if you qualify. Click here to Find Out If You Qualify In 60 Seconds»

We recently spoke with Jenny G. from Ohio. She went through a divorce. The divorce process was expensive. Plus, she was stuck with a house payment and bills she used to split with her husband. Now she had to pay them by herself. The divorce and the bills left her with over $30,000 in credit card debt.

She needed to get out of her soul crushing debt. Her boss has always been great with money, so she asked him for advice. He looked at all her credit card debt and personal financial history. He noticed she was eligible for the Federal Debt Relief Program. He suggested she apply ASAP before she got anymore interest chargers.

Jenny’s ex-husband had always handled the finances but with him out of the picture she was forced to do her own research. Jenny visited a lot of debt relief companies but none of them honored the Federal Debt Relief Program. She then entered some information on a little known site called Consumer Shield. She was shocked by the results. It was the only site that automatically honored Federal Debt Relief Program.

“They Automatically Contacted My Credit Card Companies, Reduced My Unaffordable Debt, Froze My Interest Charges and Got Me Debt Free In 36 Months. It’s Been The Best Thing To happen To Me In 30 Years.”

-Jenny G.

Jenny only had to pay what she could afford. They helped her budget from payday to payday without running out of money. The best part is Jenny doesn’t get anymore more debt collection letters or phone calls.

Choose Your Age To Check If You Qualify:

Do I Qualify?

Getting out of your debt may seem impossible but you can do it. You just need the right help. When you reduce your unaffordable debt to a single affordable payment, your life will change. Everyone with more than $15,000 in debt should at least see if they qualify.

Here How You Do It

- Step 1 – Click your age below to start your qualification check

- Step 2 – Answer a few simple questions to see if you qualify to write off unaffordable debt

Choose Your Age To Check If You Qualify:

THIS IS AN ADVERTORIAL AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE

*Clients who make all their monthly program deposits pay approximately 50% of their enrolled balance before fees, or 65% to 85% including fees, over 24 to 48 months (some programs lengths can go higher). Not all clients are able to complete our program for various reasons, including their ability to save sufficient funds. Our estimates are based on prior results, which will vary depending on your specific circumstances. We do not guarantee that your debts will be resolved for a specific amount or percentage or within a specific period of time. We do not assume your debts, make monthly payments to creditors or provide tax, bankruptcy, accounting or legal advice or credit repair services. Our service is not available in all states and our fees may vary from state to state. Please contact a tax professional to discuss potential tax consequences of less than full balance debt resolution. Read and understand all program materials prior to enrollment. The use of debt settlement services will likely adversely affect your creditworthiness, may result in you being subject to collections or being sued by creditors or collectors and may increase the outstanding balances of your enrolled accounts due to the accrual of fees and interest. However, negotiated settlements we obtain on your behalf resolve the entire account, including all accrued fees and interest. C.P.D. Reg. No. T.S. 12-03825.