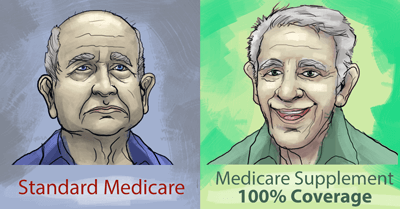

California ‐ Over 95% of seniors are paying more than $5,000 per year out of pocket on medical expenses – but a new Medicare solution is changing that.

Are you aware that your deductibles and co-pays could be covered by Medicare with a supplemental plan? These special plans are only available to those in qualified zip codes in California.

For a long time, the only way to find out about these plans was to call each individual insurance company in California, and then you would have to decide from there which plan to enroll in. This means calling dozens of different companies. Now all this work is not needed. Thanks to this innovative Medicare solution, you can view all the available Medicare supplement plans in one place online, and choose for yourself which one to enroll in.

What exactly do you need to do? Here is one easy rule to follow.

You have to compare plans. Don’t even consider enrolling in a Medicare Supplement plan without doing this first. Looking at recent studies of Medicare subscribers in America, we just couldn’t believe how many people were paying for a Medicare Supplement plan that didn’t provide them with full coverage. With this new Medicare solution, comparing plans is a breeze. Their network of top insurance companies, and 124,000 agents helps California seniors save more money on their medical expenses.

Seniors in America don’t always realize that they could be saving up to 100% per year on their medical expenses by enrolling in a good Medicare Supplement plan. This is because the information hasn’t been readily available until now, and also because many seniors get pushed into Medicare Supplement plans that don’t actually provide good coverage. Fortunately, a lot of smart seniors out there figured out how to enroll in the right plan using this free service to find the perfect plan.

It’s really no wonder that with so many seniors saving money on their medical expenses, this new service is gaining momentum. They are an efficient source that tries to give consumers access to the Medicare Supplement plans that have the highest coverage at the lowest prices.

Follow These Steps to Save Money:

- Simply check your ZIP code below.

- Answer some basic health information and then view all of your available Medicare Supplement plans and coverages.

- Put money back into your pocket every year!

THIS IS AN ADVERTORIAL AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE

*Clients who make all their monthly program deposits pay approximately 50% of their enrolled balance before fees, or 65% to 85% including fees, over 24 to 48 months (some programs lengths can go higher). Not all clients are able to complete our program for various reasons, including their ability to save sufficient funds. Our estimates are based on prior results, which will vary depending on your specific circumstances. We do not guarantee that your debts will be resolved for a specific amount or percentage or within a specific period of time. We do not assume your debts, make monthly payments to creditors or provide tax, bankruptcy, accounting or legal advice or credit repair services. Our service is not available in all states and our fees may vary from state to state. Please contact a tax professional to discuss potential tax consequences of less than full balance debt resolution. Read and understand all program materials prior to enrollment. The use of debt settlement services will likely adversely affect your creditworthiness, may result in you being subject to collections or being sued by creditors or collectors and may increase the outstanding balances of your enrolled accounts due to the accrual of fees and interest. However, negotiated settlements we obtain on your behalf resolve the entire account, including all accrued fees and interest. C.P.D. Reg. No. T.S. 12-03825.