If you are a woman between the ages of 25 and 54, live within 60 miles of and have not had a DUI in the last 3 years then you might be paying too much for car insurance.

California Insurance Commissioner Dave Jones has enforced 3 pricing bans that have the car insurance companies raising hell.

Here are the 3 bans:

- Ban On Raising Your Rates Based On Gender

- Ban On Raising Your Rates Based On Education Level

- Ban On Raising Your Rates Based On Credit History

Car insurance companies determine how much to charge using software called the “price optimization tool”. The problem with this tool is the car insurance companies can program it to charge you whatever they want. California Insurance Commissioner Dave Jones enforced bans on these 3 areas because studies show these areas could be used to give you high car insurance rates. Here is how you may have been overcharged:

Raising Rates Based On Your Gender

Men are:

- 10% More Likely To Not Wear Seatbelts

- 24% More Likely To Get Speeding Tickets

- 72% More Likely To Get a DUI

This means a man is more likely to get behind the wheel drunk, not put on a seat belt and then drive fast. However, some car insurances companies charge women significantly higher rates than men. Its rumored car insurance companies could charge your more if you were a woman who drove more than 5 miles a day, had a ticket within the last 10 years, were single or married. The California Department of Insurance did an investigation and found no consistent reason why.

For the lack of consistency, California put a ban on gender based pricing but some car insurance companies have been slow to react. Your agent may not have updated your rates or applied your discount if you were previously being overcharged.

Raising Rates Based On Education Level

A recent study showed the lower your education the higher rates. The higher your education the lower your rates. This means in some states a doctor could pay 45% less for car insurance than you.

Why Do People Who Can Afford Car Insurance Pay Less For It?

It is because of “out of pocket” cost. If a doctor gets in a minor accident they can afford to pay out of pocket and avoid filing an insurance claim. This keeps the accident off their record.

If an everyday worker gets in a car wreck she will likely file a claim. Which means the insurance company will have to pay for it. So, in order to make up for the risk, the insurance companies may program price optimization tool to charge you 19%-45% more for car insurance.

The California Department of Insurance put an end to this. However, some female California drivers are still paying higher rates on quotes that may have included their education level. Has your agent told you about this?

Raising Rates Based On Your Credit Score

Your credit score is used by companies to determine how much of a risk you are. As a result insurance companies use your credit history when calculating your quote. Here is the problem. If you credit score is below “excellent” then you could pay up to 67% more for car insurance.

Also, it’s been speculated if your credit score is “excellent” then you could be charged more because you have a proven track record of paying bills on time regardless of the price. Once again, there is no rhyme or reason to how they use your credit score to calculate your rates. It seems they do what is in the best interest of their company. As a result, California Department of Insurance put an end to this. Do you know if your credit history was factored into your current rate?

Are You Being Overcharged

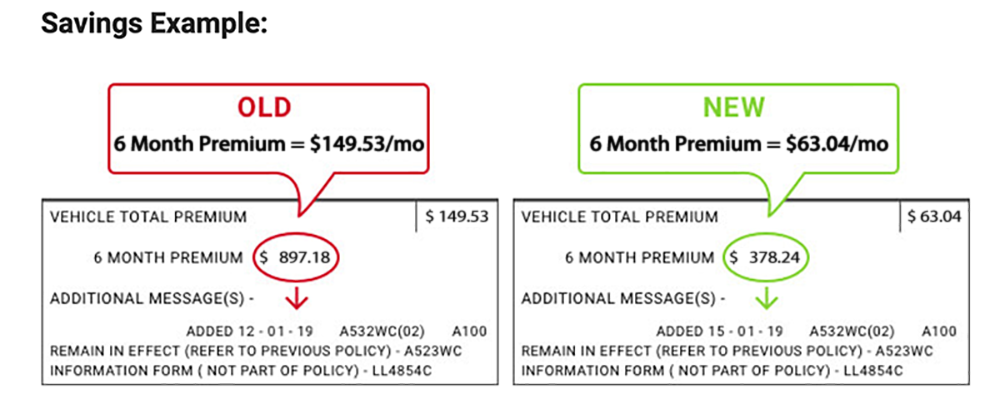

We had 1,000 female driver between the ages of 25 and 54 enter their information on Insurance Protector. We used this site because our research showed it to be reliable when giving you quotes that include the updated bans as well as any discounts you qualify for. Of the 1,000 drivers 978 of them were being overcharged in some form or fashion. We investigated even further and we have reason to believe these women were overcharged because they received car insurance quotes before the recent ban.

Has Your Agent Told You About This?

Unfortunately the answer is often “no”. This is because your agent is paid commission which means the more you pay, the more money they can put in their pockets. Below is a list of car insurance discounts as well as their average yearly savings:

- No Tickets In 12 Months: $87

- No Accidents In 12 Months: $107

- Low Yearly Mileage: $84

- Homeownership: $52

- Cars Containing Back Up Cameras: $27

- Life Insurance Policy: $34

- Using The Automatic Payment Option: $25

- Short Commutes: $52

- Days Driven Per Week : $32

- Car Ownership: $30

- College Degree or Higher: $30

You will have to call your agent and ask about each discount individually or you can go to ConsumerSavingsToday.com and get quotes that automatically include all the discounts you qualify for.

In addition, If you live 50 miles within , are currently insured and have not had a ticket in 12 months, then you may qualify for additional discounts.

You should at least see what discounts you qualify for. Its free, takes less than 60 seconds and could save you thousands.

I hope all these tips help you save money and avoid trouble with the law.

Here’s How You Do It:

Step 1: Tap The Link Below

Step 2: Enter Your Zip Code

TIP: (You are never locked into your current policy. You can cancel at any time and your remaining balance will be refunded)

*Source: https://www.cbsnews.com/news/car-insurance-california-bans-gender-as-a-factor-in-setting-rates/

*Source: https://www.insurancejournal.com/news/national/2019/02/12/517466.htm

*Study: https://consumerfed.org/press_release/large-auto-insurers-charge-40-60-year-old-women-higher-rates-men-often-100-per-year/

*Job Impact Insurance: https://quotewizard.com/auto-insurance/job-or-occupation-and-auto-insurance-rates

*Source (Why Men Pay More): https://www.esurance.com/info/car/why-women-pay-less-for-car-insurance and https://coverhound.com/insurance-learning-center/guys-vs-girls-who-pays-more-for-car-insurance

*Price Optimization: https://www.naic.org/cipr_topics/topic_price_optimization.htm

*Women and Driving: https://www.syracuse.com/news/2011/07/women_worse_drivers_more_crashes_than_men_less_driving.html

*Credit Score and Driving: https://www.ftc.gov/sites/default/files/documents/reports/credit-based-insurance-scores-impacts-consumers-automobile-insurance-report-congress-federal-trade/p044804facta_report_credit-based_insurance_scores.pdf#page=30

https://www.doughroller.net/insurance/does-bad-credit-affect-car-insurance-rates/

https://www.nerdwallet.com/blog/insurance/car-insurance-rate-increases-poor-credit/

https://www.edmunds.com/auto-insurance/does-your-credit-score-affect-your-car-insurance-rate.html

https://www.progressive.com/content/PDF/shop/UTCreditStudy.pdf

https://wallethub.com/edu/car-insurance-by-credit-score-report/4343/